94% OF THE S&P IS TRADING ABOVE ITS 50 DAY MOVING AVERAGE

31 OCTOBER 2011 BY CULLEN ROCHE 18 COMMENTS

It’s moments like this when technical indicators can provide very valuable insights. Glancing at a quick chart or a statistical data set can be enormously enlightening. The current short-term technicals could be a reason for some concern here as we are reaching unprecedented levels according to some indicators. When markets make extreme movements we often enter brief periods of statistical anomaly.

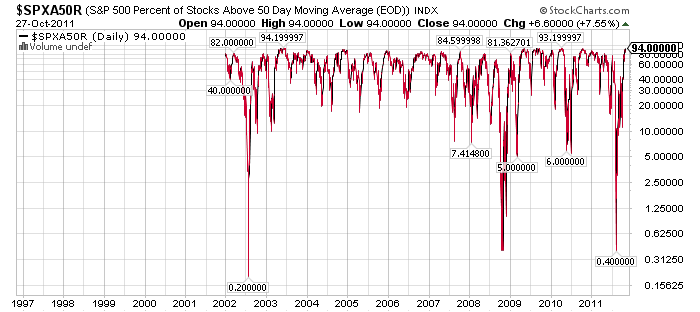

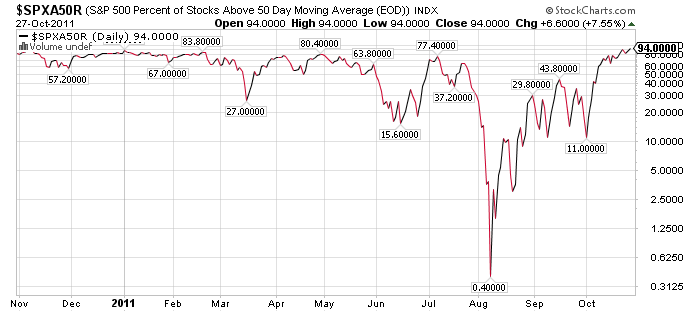

The current cause for some concern is the market’s extraordinary overbought conditions based on some metrics. The most eye opening of which is the % of S&P 500 stocks above their 50 day moving average. The current reading of 94% has been registered just once in the last 10 years. I’ve provided both long-term and short-term charts below:

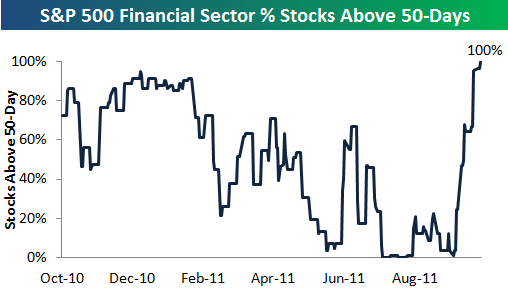

On Friday Bespoke Investments noted the even more extreme situation in financials. 100% of the S&P 500 financial sector is now trading above its 50 day moving average:

If you’re a believer in mean reversion you have to start wondering if the recent rally hasn’t been overdone. Granted, this is just one indicator out of the hundreds that investors should follow, but rare data points such as the above are always worth noting….

Source: StockCharts.com

COMMENTS GUIDELINE - Readers who denigrate authors or other readers will be banned without warning. This site does not tolerate any sort of reader abuse. The goal of this site is to create an environment that is conducive to learning and better understanding of the monetary system and the investment world. We expect readers to behave maturely and responsibly. We welcome and encourage intense and intelligent discourse, but the site adheres to a strict 1 strike policy. While it is your right to speak freely, it is not your right to behave childishly. Above all else, please enjoy the site. It is intended to be used as an educational tool and we hope the intelligent and mature debate will further that purpose. We hope readers will make an effort to respect that goal. Comments with excessive linking or foul language will be moderated before posting.

Comments

David Lightman: What’s that?

Stephen Falken: Futility. That there’s a time when you should just give up.